Find out the meaning of having a credit score of 750. Read how scores are calculated, what loans you can get, and how to better your score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

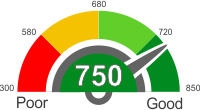

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score of 750

Looking at a FICO chart, a credit score of 750 is considerably excellent. Individuals having a credit score ranging from 750-799 are considered as having a rather good credit score. Approximately 18% of Americans have this credit score. Even though it looks high on most of the people, excellent credit is possible to achieve. What you need to do is to make consistent efforts of paying down all your debts in time and maintaining a high level of credit balance. An individual with an excellent credit score is considered to having enough information on how they keep their credit above this level. Establishing a solid foundation of credit means having achieved an excellent credit status.

What a credit score of 750 can do for you

The first thing to do when you have an excellent credit score is to try and negotiate your loan interests. With an excellent credit score, you will be attractive to lenders, and some will still want to pull you their way. Therefore this is an opportunity to negotiate your loans and bargain for excellent interests. Due to your excellent credit score status lenders are likely to reduce their interest rates so as to do business with you. They know you will pay back on time. The interest rate you pay throughout a lifetime of loan is significant, more especially when you bargain a loan.

Growing your score of 700

There are some cases you might have grown from lower credit score to higher credit score. If you took a mortgage with a credit score of below 600, you are in good position to go back to the bank to negotiate you montage. Take advantage of excellent credit score to refinance your montage, finish paying lower interest rates with the new loans on offer for you, more so, financial advisors will tell you that you need to use excellent credit to save money. The good news with giving money is that you will still grow your credit score to perfection. Aim at 850 and the way to do that when at 750 is an opportunity that you have.

Credit cards you can get with a credit score of 750

Getting your credit card application approved will highly depend on what credit score you currently have.

Applying for credit cards can be difficult or easy depending on the credit score that you have. For people with a credit score of 750, getting a card can be easier since this is known as a good score. Here are some of the banks where you will most probably get approved.

Starwood from American Express

Starwood credit card from American Express has a sign-up bonus, where you can earn 25,000 points after spending USD 3,000 on purchases. The first annual fee is zero and USD 95 after that.

Chase Slate

Chase Slate has an introductory APR of zero percent for the first 15 months on balance transfers and purchases. It also lets you access your credit score for you to be able to get updated on your score.

Car loans with a credit score of 750

If you are getting a car loan with a credit score of 750, then worry no more since this rating is considered an excellent one.

Getting a credit score of 750 shows the financing companies that you can pay your debts promptly. But there will still be companies that might give you a high-interest rate, especially if you don't know how to find the best company with the best price for you.

Interest Rate with a credit score of 750

People with a credit score of 750 can usually receive an interest rate of 2%. Now, if you are loaning USD 25,000, your monthly payment would be USD 438. Having a high credit score can help you save USD 100 every single month for your auto payments.

Make the Most Out of Your credit score 750

Now if the financing company is not providing you with the lowest possible interest rate that you can have, then move on to the next. There are a lot of lenders out there that give an excellent rating for people with a credit score of 750. That is why it would be best to be patient and shop around more.

Mortgages with a credit score of 750

A score of 750 will help you in getting your loan approvals quickly. You can go to the major banks and other lending institutions and apply for a home loan or mortgage. If there is nothing seriously wrong with your application, they will provide you with a suitable loan plan or offer.

Moreover, you should keep an eye on the government loans for new homes or mortgage. They offer loans with easy terms and conditions of lower interest rates compared to the market.

With this score, the above-mentioned ways of acquiring credit should be sufficient. However, if you want to lend through your credit card, you can do that too. However, you might want to have a look at the cost of credit associated with your credit card.

Home Loans with a credit score of 750

People with a credit score of 750 should know how they can use it to their advantage when applying for home loans.

A credit score of 750 is known as an excellent score and people with this score are usually known as good in paying their debts on time. If you are applying for a home loan, it would be best to know the advantages that you can get for having a 750 credit score.

Negotiations

Some lending companies will have higher interest rates and negotiating with them is ideal. You can negotiate with them to let them reduce the rate of the loan that you are getting.

Refinancing

You can refinance the loan that you are planning to lessen the money that you are going to pay with your lender. It will save you a lot of money, which you can use for other things.

Personal Loans with a credit score of 750

As your credit score improves, your eligibility for personal loans with low-interest rates increases. With good credit, you stand a chance of enjoying single digit interest rates. More personal loan avenues are available to you on this score; from banks to non-bank lenders.

Credit union loans

It is highly encouraged for you to join a member of a credit union. These institutions provide low-interest rate loans to their members. You stand a very high chance of securing a personal loan quickly due to the financial responsibility you exhibit with a good credit score.

Friends and family

You can easily be trusted to pay back the loan promptly to your friends and relatives. It is quite easy to get a loan from them without interest.

Unsecured loans

You are almost guaranteed an unsecured loan from a bank with this score. Banks prefer customers with high credit score since they consider them risk-free. Nobody wants to damage their credit score with loans they can't pay.

Things you can do to improve your credit score of 750

You don't have to pay a credit repair company to help you in fixing your credit score. There are some easy steps you can take to improve your credit score without involving any third party. The loan agreement is made between you and the lender hence suggesting a secondary may prove injurious to your rating.

Pay off your debts

You can enhance your credit score by reducing the amount of debt you have. You can do this by giving priority to the debts attracting higher interest. You also lower the amount of interest you pay thus increasing your credit score.

Consolidate your credit cards

If you own several cards from one financier, you can amalgamate the newer ones into the older ones. You only have to ensure the total limit remains unchanged. This action increases the average age of the revolving lines of credit while your total credit is not restricted.

Don't be late with your premiums

This method has been tried and tested and proved to be efficient. Making timely payments as per the loan terms is crucial to being in control of your debt helping you in increasing your credit score.