Find out the meaning of having a credit score of 721. Read how scores are calculated, what loans you can get, and how to better your score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

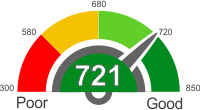

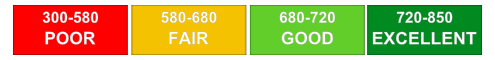

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score of 721

The credit range chart rate a credit score of 721 is really good. It is important to note that a credit score of 721 from one credit reference bureau is different from a credit score you will get from another company. If you have a credit score of 721, find out whether you have this credit score figure from at least three credit reference bureaus. Common behavior of credit score is having it at 721 in one company and having it fluctuate in another company. Lenders and creditors are likely to use three figures from three different bureaus. FICO perceives a credit score of 721 as between good and average credit to good credit. Therefore a 721 credit would be good, but one score from one credit reference agency is not going to help you. Issues will use the average and not extreme figures.

Getting and maintaining a credit score of 721

It is not common to get a credit score of 721 and keep it for a long time. However, it is possible to maintain your 721 credit score and above. If you pay bills on time maintain a low credit balance and revise age accounts, you are likely to stay in a positive credit card score range. The contrary to these good financial behaviors are also true. Keeping a credit score of 721 needs you to work upward. With this credit score it is not the time to try and get too many credit cards, more credit, and huge loans. The financial fluctuations will land you in the ditch and ruin your credit history. People who get loans within a short period are perceived as incubating financial problem. A good borrower will need to borrow from one lender and finish repaying the loan and repay the loan on time so that they can continue borrowing from another lender. Servicing several loans at ago is difficult.

What you can do with a credit score of 721

You need to make it at 721 as your lower limit of three figures from three different bureaus. That way you can probably do anything you want to do with the credit from borrowers, you can get a montage and direct bank loan for a new car. However, even with a credit score of 721 get credit, but bear in mind that you will not get the best interest rates.

Credit cards you can get with a credit score of 721

A credit score of 721 is known as a fair to a good score, so if you are planning to apply for a credit card with this credit score, then you wouldn't be having problems at all.

While 721 is a good score, this does not mean that it's a great one. Banks may make it easy for you to apply for a credit card, but there will always be some banks that won't be considerate enough. Below are the different cards that you can have with a credit score of 721.

Barclaycard Rewards MasterCard

Barclaycard Rewards MasterCard offers twice the points on grocery, utility, and gas stores. They don't have an annual fee, and their APR is 25.24%.

Capital One Quicksilver

Capital One Quicksilver will let you earn an unlimited 1.5% cash back for every purchase that you will make. Plus, they offer a free Uber ride up to USD 15 every 10th.

Car loans with a credit score of 721

With a credit score of 721, getting a car loan can make your life a little easier, since a credit score of 721 is known to be a fair rating. Found out more about getting car loans with a credit score of 721.

Financing companies today can give an interest rate for people who have a rating of 721 of up to 2.9% for 60 months. But there are of course other companies who can give you a much lower rating, depending on the term of your loan.

Getting the Best Rate

If you want to get the best rate available for your credit score, then determining how long you are planning to pay the loan is essential. It would also be best to know the monthly budget that you can set aside for the loan. Usually, the longer the term, the lower the rate.

Choosing the Lender

There are a lot of financing companies to choose from when getting a car loan. You can start by going to your local bank, car dealer or the credit union. It will help you find out which of these companies can give you the lowest interest rate for the car loan that you need.

Mortgages with a credit score of 721

When you apply for a home loan or mortgage, the banks will consider your credit score. With a credit score of 721, which is considered to be good by analysts, can get you mortgage or home loans at very good interest rates and manageable terms and conditions.

You can get approval for government home leasing plans and FHA approved loans. Applying for government plans is always beneficial as they offer easy terms and conditions and the interest rates are lower than the average rates offered in the market.

With this score, getting a loan for a mortgage through credit card does not seem like the best option. Because your credit score will be affected and you will be subject to higher interest rate payments.

Home Loans with a credit score of 721

Home loans with a credit score of 721 are easier to obtain, but it is important to know the things that you need to expect when getting a loan.

An above average credit score of 721 will let you get a home loan for the house that you want to buy. Of course, this also means that you need to make sure that you can pay the money that is going to borrow.

Affordability

One of the things that you need to make sure is the monthly payment that you can afford. Budget your money so you know how much you can allot regularly for the home loan that you are going to borrow.

Down Payment

Giving the company a down payment will eliminate or reduce the mortgage insurance. It will, of course, reduce the amount of loan that the lending company will give you.

Personal Loans with a credit score of 721

Most people prefer personal loans when they are need of financing their day to day activities. At 721 and above, your credit score is considered good thus making you eligible for a wide variety of personal loans. You can quickly acquire long-term loans if your aim is to invest in something.

Secured personal loans

Some banks may require you to provide security for your personal loan. With this credit score, you enjoy personal loans at competitive interest rates.

Unsecured personal loans

You don't need collateral to be issued with this since your credit score indicates that you are fairly responsible financially. This kind of loan is repaid in installments and comes with a fixed repayment period.

Peer to peer loans

Your personal loan is much more likely to be approved on online peer to peer lending services with this score. Examples of services you can rely on include LendingClub and Prosper. Go through all the available options before settling on the best one since a difference of 0.01 in the interest rate counts a lot.

Things you can do to improve your credit score of 721

A credit score of 721 and above shows that your financial management is satisfactory, and you can be trusted with significant credit. However, there is no infliction in trying to make it better. Be careful not to go for huge credit that increases the risk of defaulting leading to a decline in your credit score. Below are several tips to help you.

Diversify your credit

Diversity in the loans you take over a given period contributes to ten percent of your credit score. If you can comfortably service a student loan, an auto loan, and credit card expenses over the same period, it indicates a high level of financial maturity increasing your credit score.

Pay on time

Ensure you pay the minimum premium before o when it is due. Delaying payment even or a few days lowers your credit score. It indicates financial carelessness and that you cannot be trusted with huge amounts of money.

Look out for errors in your credit report

Go through your credit report and be cautious of any mistakes. Look out for omissions and understatements that could injure your credit rating. You are allowed to dispute any records through agencies such as Equifax and Experian.