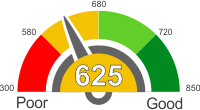

Find out the meaning of having a credit score of 625. Read how scores are calculated, what loans you can get, and how to better your score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score of 625

In the financial industry, bad credit is anything below 625. Individuals whose scores have gone above 625 up to 640 are considered having a poor credit score, but they are not high-risk borrowers. These individuals are still able to borrow loans, but with high-interest rates. When you have a credit score of 625, you are not regarded as a borrower, and that is why you need to work up your credit score to the better score.

Determining your credit score

If you do not know your credit history, you can use the following criteria to gauge whether you have a positive credit history. Determine the length of your credit history, determine the status of your accounts and history of repayments, determine your total debts, determine your type of credit cards you use, the student loan is also factored in determining your overall credit score. Individual with a credit score literacy are likely to score a high credit score because they know that they need show consistency in timely payments, and debts that they incur, the status of their accounts are always positive. However, the finance fluctuation has become to remain almost a permanent situation that affects individual's credit score.

Risk of financial traps

The risk which is incurred when you have a credit score of 625 is that you will be tempted to borrow more because you're likely to be approved by many lenders. Creditors will come looking for you. Many credit companies will make you their friend. The attractive financial packages are dangerous because they come with a liability. If you fall in these financial traps, be sure you are going to hurt your credit score. It pays to retain from accepting credit offers. Most credit offers come with a huge financial liability suggesting that they can easily revert you into a negative credit score.

Credit cards you can get with a credit score of 625

There are a lot of credit cards for people with a credit score of 625, find out by reading the information below.

Credit cards are a necessity, that is why getting one for yourself is important. If you've been getting declined, then worry no more because there are banks that cater to people with a credit score of 625. They don't also need too many requirements, so you surely won't have any problems at all.

Rewards Visa Card

Rewards Visa Card has no annual fee with a 0% APR for the first nine months. For every USD 1, Kroger family products spent, you get to earn 3 points.

NFL Extra Points Credit Card

NFL Extra Points Credit Card has no annual fee and will let you earn a bonus of 10,000 when you spend USD 500 on your purchases. Purchasing from NFLShop.com will give you a 20% discount.

Car loans with a credit score of 625

Whether you are purchasing a brand new car or a used one, having a good credit score is essential, for you to be able to get the car loan that you need.

The good thing about having a credit score of 625 is that most financing companies can consider you for a car loan if you have a steady flow of income. Below are some of the other factors to look out for, for you to be able to get the car loan that you need.

Factors to Consider

Most financing companies will check the down payment that you can provide them before granting you the loan that you need. Of course, the amount and the length of your loan are big factors as well

Interest Rate for Car Loans with a credit score of 625

Lenders usually offer 10% interest or more to people who have credit scores of 625. Fortunately, you can avoid paying for an enormous interest by giving them a bigger down payment.

Mortgages with a credit score of 625

A credit score of 625 is considered to be a good enough to get you a formidable mortgage or home loan through conventional on the non-conventional mean. You can check with your local and mid-tier banks. You can check their interest rates and their conditions for lending you credit for your mortgage or house loans.

If you do not feel comfortable with their offers and discount rates, you can go government sponsored plans for mortgage and home loans. You can get loans from FHA approved lenders with a score above 580. In 2016, a minimum credit score of 580 was set to be the limit to apply for FHA approved loans.

Home Loans with a credit score of 625

Getting home loans with a credit score of 625 can be a little easier since this is known as a fair score.

Home loans are usually essential for people to be able to get their new homes without breaking their banks. But sometimes their credit scores can get in the way; wherein they end up being declined. The good news is, there are still lending companies who are willing to give considerations.

Better Mortgage

Better Mortgage provides home loans to people with a credit score of 625. You can provide them with a 20% down payment if you prefer to lower down your payment monthly.

Sebonic Financial

Sebonic Financial offers an APR of 3.336%. Their interest rate is 3.250% for people who have fair to good credit score.

First Tech Credit Union

First Tech Credit Union has an APR of 3.529%, and their interest rate is 3.500% for people who have fair to good credit score.

Personal Loans with a credit score of 625

Even though you get yourself into a bad credit position, you still need personal loans to meet your financial needs. Loan packages exist that have been designed for people with poor credit scores. Most of these solutions you can turn to are online based solutions.

Avant:

It can process your loan within a day for credit scores of as low as 580. You stand to benefit from their fixed terms and interest rates. They, however, charge an upfront origination fee. It is possible to check your rate without damaging your score.

LendingClub

With a credit score history of more than 36 months, you qualify for a personal loan from LendingClub. They charge low-interest rates for individuals with a credit score below 700 while the processing time takes a few minutes. You can take a loan for up to 60 months.

OneMain

You can get a loan of up to $10,000 and a repayment period of 60 months. This lender requires a face to face interaction before the loan request is approved. You need to prove employment and income, as well as no filing for bankruptcy.

Things you can do to improve your credit score of 625

Good credit will secure your access to cheap credit with better rates and flexible repayment terms. Bad credit shouldn't stop you from obtaining these loans since you can work on improving it. Lenders always give borrowers with good credit a priority when issuing loans hence the need to work on improving it.

Pay credit and other bills on time

Your payment history accounts for about thirty-five percent of your credit score. You should, therefore, ensure you pay your loan on time. You can improve your rating by paying the minimum premium set for each month promptly.

Monitor your credit report

You can request a free credit report from various agencies every four months via AnnualCreditReport.com. When potential lenders do a hard pull of your credit report, your credit score gets slightly damaged. However, you are not penalized if you check it by yourself.

Avoid multiple credit cards simultaneously

A hard pull is conducted on your credit score when applying for a credit card. You should avoid holding multiple credit cards since this translates to several hard pulls that lower your credit score.