You have to be aware of the factors considered when calculating your credit score in India. Otherwise, you might get a rating you don't deserve.

Your credit score indicates whether you are a high-risk or low-risk borrower. Low-risk borrowers have a higher credit score while high-risk borrowers have a lower score. In India, a majority of borrowers fall in the high-risk category. Moreover, only a few of them understand what a credit score is and its effect on their effort to obtain credit. Several factors are put into consideration for the credit score calculator in India.

Payment history

The payment behavior of both past and present credit influences your rating. Late payment and default impact negatively on your credit score. Timely payments boost your score. Similarly, utilizing the maximum limit of all your credit lines sets back your rating. Additionally, opening credit lines without using them also damages your credit score.

Credit history

When calculating your credit score in India, the length of time that you have accessed credit is considered. A longer credit history has a positive effect on your rating. First-time loan applicants are severely affected by this factor since they have no history that qualifies them for loans. It is due to the absence of proof that the first time applicant can repay and can be trusted with credit.

Recent credit applications

The loan applications you have made in the immediate past is factored when calculating your credit score in India. It indicates whether you are undergoing financial stress and your desperation for credit. As a borrower, you are advised not to make frequent loan applications especially if you don't need them, and are aware you don't qualify. If you are comparing the rates between different providers, just make an inquiry instead of an application.

What to look out for when calculating your score

There are things you should closely check when your credit score is being calculated in India. They include up to date personal information (name, address, contact details, etc.), any fraudulent accounts opened under your name, inquiries shown in your report and open and closed accounts. This information is crucial when calculating your score and errors could affect it negatively.

What is a credit score in India

Familiarize yourself with a credit scores in India by reading the information below.

CIBIL is India's credit information company, which collects and maintain all the information on an individual's credit card and loan. Find out more about credit score in India below.

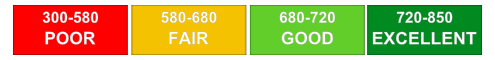

Credit Score Range

The credit score ranges from 300 to 900, wherein the closer your score is to 900, the more confident the lending company is with you when it comes to granting you your loans. If your score is less than 750, most lending companies will see you as high risk, which can lessen your chances of getting approved.

Benefits of Having Good CIBIL

There are a lot of advantages of having good CIBIL, such as getting a higher amount of your loan, lower interest rate, and a fast approval of the loan. Some companies will also give you a longer repayment period, which means lower monthly dues for you.

How are credit scores calculated in India

In India, credit score is calculated by Credit Information Bureau of India Limited (CIBIL) which first started collecting borrower's information. It is also known as the CIBIL TransUnion score which is measured in a range of 300 to 900. Closest to 900 shows better creditworthiness and little probability of the creditor defaulting on his or her payments.

The CIBIL TransUnion score is based on five factors. First, is the applicant's repayment history which accounts for 35 % of the total score. Second is the credit balance which accounts for 30 % of the credit score in India. Followed by the amount of time for credit use which is responsible for 15 % of the rating on your CIBIL score. Final 10 % is for your overall credit mix.

The CIBIL score that is calculated using the weights mentioned above is responsible for approval, disapproval or the type of credit when you apply for loans in India.

Explanation of credit score ranges in India

A lot of people are wondering about the explanation of credit score ranges in India. Let's find out by reading the information below.

The credit score in India ranges from 300 to 900. The higher your score, the easier it is for credit companies to trust you. You can easily get a loan or a credit card without providing too many requirements.

A Good credit score

A good credit score ranges from 750 to 900 and most banks and financial institutions see people who have this score as low risk. This means that they are comfortable in approving credit card or loan applications to these people.

A Bad credit score

A bad credit score ranges from 300 to 749 and banks and financial institutions see people who have this score as high risk. They usually require more requirements before granting them their applications.