Thought you ran out of luck? Not so first! There are still a number of mortgage companies that are willing to lend regardless of your low credit score. Maybe it is about time you applied for a mortgage from a mortgage especially if any of the following reasons appeal to you:? Your credit remains unpaid because you could not meet with the high interest demands. You have been declared bankrupt and are in desperate need for low mortgage credit companies.? You have court judgments against your name

While low credit score mortgage companies sound lucrative, they are often more strict with their interest rates. When getting a mortgage with a low credit score, it is essential to shop around and compare fees and impending charges so that you could only settle for the best one. Do not be tempted to remortgage, as this will only complicate your financial situation. Low credit score mortgage companies allows you to borrow money as per your income.

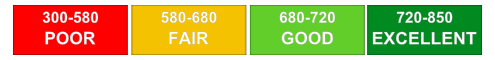

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Mortgage options based on credit score

A high credit score shows high creditworthiness and a lower credit score shows lower creditworthiness. The credit score consists of credit-related information such as your credit payments history, outstanding debts etc. The banks and the lending institutions will be most willing to lend you if you have an excellent credit score that is, over the 720 mark.

However, if you have a lower credit score, you might want to check with the FHA loans or other non-conventional means of getting credit. If you have a low score, you may get a mortgage from the bank, however, you will be asked to pay higher amounts of the interest rate on the loan amount.