Find out all the information that you need about the minimum credit score for mortgage UK.

Find out the minimum credit score for mortgage UK by reading the information below.

Most lenders in the UK are using Fair Isaac Corporation to check the credit scores of their applicants. The reason behind this is because this will help them check how low or high risk their applicants can be. Find out more about it by the given information below.

Credit Score Needed

People who have a score of 620 to 650 are considered as a good score, but they can still be categorized as individuals who are high risk. If you have a score of 720 and above, it is known as an excellent score, which will make lenders categorize you as a low risk.

Low Credit Score

For people who have 620 and below credit scores may still qualify for a mortgage in the UK since there are mortgage companies that cater to individuals with a low credit score. Of course, this will usually come with a higher interest rate.

What is a credit score in UK

Find out the average credit score in the UK using the information below.

As you all know, a credit score is the one helping measure an individual's creditworthiness. Having low credit score means that you are high-risk while having a higher credit score proves that you are creditworthy.

Usefulness of credit score in UK

A credit score is useful in making decisions for lending companies and banks. This is one of their primary basis if they are going to grant you the loan or the credit card that you need. That is why it is important always make sure that you have a good credit score.

Low Credit Score

If you happen to have a low credit score, then you know that your chances of getting approved are low. But you can still get approved though lending companies might offer you with higher interest rates.

How are credit scores calculated in UK

A credit score ranges from 0 to 999 depending on the different models that are used by various credit bureaus or credit firms in the country. Higher the credit, higher is the probability of the person paying back the loan.

In England, like many other developed countries, some variables account for the credit score. These variables include the following:

First is your personal information. Secondly, the credit history of the person applying for the loan. The number of inquiries made for credit in the recent past is also considered when your credit score is determined. Your public records also play a significant role in the calculation of your credit score.

Whenever you apply for a loan, your credit score will be considered to evaluate the level of risk involved in lending you the loan.

Explanation of credit score ranges in UK

Knowing what category you fall into when it comes to your credit score is essential, for you to know what to expect when applying for a loan or a credit card.

There are different explanations of credit score ranges in the UK that you need to know. They usually range from 0 to 999 and knowing what category you fall in is important. Here are some of the information that you need to know.

Very Poor

Very poor credit ranges from 0 to 560. People with this credit score will have a hard time getting approved because most lenders will think that they don't have the capabilities of repaying their credit.

Good to Excellent

Good to excellent credit score ranges from 721 to 999. They are the ones that can easily get approved when it comes to applying for loans and credit cards. They also get the lowest interest rates.

Mortgage options UK based on credit score

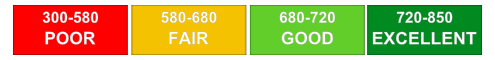

The credit score can range anywhere from 300 to 850 for the FICO scoring model. A high credit score shows high creditworthiness for the customer. With a credit score over 700, you can expect to get the best rates for the loan or credit.

If you have a lower credit score, for example; below 580, you will be paying higher interest rates on the loan and the terms and conditions of the loan will also be strict. A further lower score may push to go to non-conventional means of getting a home loan or mortgage.

Things you can do to improve your credit score UK

You may be denied credit in the UK if you have a low credit score, and when approved you are given a small amount with a high rate of interest. You need to take your time to manage and improve your credit score for better credit terms. Lenders prefer to work with borrowers with high credit scores because they have proved their financial prudence.

Make timely payments

Any late payment or default remains on your credit report for up to six years thus affecting your rating. Making timely payments puts you in good financial books and will forward a favorable report of you to credit agencies, which increases your rating. Whenever you encounter difficulties in making payment, inform your lender to give a grace period otherwise you risk damaging your credit score.

Register on the electoral roll

Your credit score can be boosted if you get registered on the Electoral Roll using your current address. Doing this would cut the delays when applying for credit since you are required to verify your residence. Some lenders can even deny you loans if they can't prove your residence.

Cut links with bad credit partners

You are connected financially to a partner whom you have a joint account with or take mortgage together. Their bad credit score could affect yours negatively. You should inform your credit agency when you dissociate with your financial partner, husband or wife. Failure to do this means that their financial undertakings keep impacting your credit score.