Consider purchasing an RV with your personal loan. It is better, and the personal loan comes with an affordable interest rate as compared to direct RV loan from your financiers. Personal loans are unsecured, and that is considered a more advantage.

Available financial information indicates that published credit score for acquiring a recreational vehicle loan is 690. A credit score of 690 is relative. Customers will have less or more than this depending on the average credit score that financiers will pull from any three credit reference bureaus. It is also possible to find different financiers applying different credit rating for these vehicles.

General financing rules apply

The general loan acquisition or financing rules apply when taking out loans to purchase RVs. The rules indicate that those with high credit score will benefit from the best rates and best loan terms and conditions. On the other hand, individuals with poor credit will have difficulties accessing RV loans. If they assess these loans, the interest rates will be high. It is imperative to note that RVs are recreational vehicles meant for entertainment. Entertainment assets are considered a luxury rather than a necessity hence the interests will be high. Banks take advantage of luxury assets. With this phenomenon, it will be abnormal to see people with poor credit taking out loans.

Acquiring a personal loan

Pure recreational vehicle loans are a rare show. However, people are more likely to use personal loans to purchase these vehicles. Personal loans come with certain freedom such as customized interest on the loan acquired as compared to the interest that will be charged on the vehicle. In other words, a personal loan to purchase an RV is more favorable than taking a pure RV loan. You can customize or manipulate your payment schedule with a personal loan hence reducing payment period and loan liabilities; something that you will not do with a direct RV loan that comes with a fixed repayment period.

RV financing options based on credit score

Recreational vehicles (RVs) and motor homes offer you a great way of exploring the country during vacations. It could be a road trip, vacation with family or a decision to become a full-time RV resident, and this requires you to evaluate the financing options available for you. Your credit score influences financiers in supporting you to obtain the RV either permanently or by leasing. Some of the financing options you can rely on are:

Unsecured RV loan

If you have good credit starting from 700 and above, you can consider applying for an unsecured personal loan for buying or renting an RV. You may qualify for a low-interest rate with your impressive credit history. A good credit utilization ratio is an added advantage for you. Your score indicates you will easily service the loan issued for the RV.

Co-signer loan for bad credit

You can still get a loan if you have a low credit score. You will need a co-signer ho has good credit to be your guarantor to purchase or rent an RV. Moreover, you will be required to present proof employment and income to support your application for a loan.

What is a credit score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

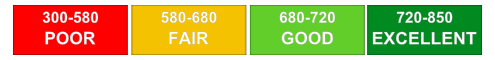

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

Things you can do to improve your credit score

Having a bad credit score is similar to having poor health. Therefore, you need to take measures that ensure you are continually improving on it. The most efficient way of repairing bad credit is good management over time. Improving your credit score is necessary for you to be eligible for better terms and rates for loans in the future.

Regular credit report checks

You are advised to monitor your credit report regularly to see if it has any errors. A credit report brings you up to speed on your status as a debtor. Ensure that the payments are reported correctly and the amount owed to each creditor is correct. Errors must be disputed to your credit bureau promptly.

Reduce your debt

Most people usually take loans just because they are eligible for them without considering the potential damage to their credit score. For a start, you can reduce your reliance on credit cards. Design a plan that ensures you give priority to your debts that have the highest interest rates.

Payment reminders

If your monthly premium is not automatically debited from your account, you need to set up a payment reminder. Timely credit repayment improves your credit score over time. Some financiers usually send emails or texts to their clients to make payments.